“Don’t Get Caught in the Real Estate Crash of 2022-2023: Protect Your Investment Now!”

(c)Natarajan S

Introduction

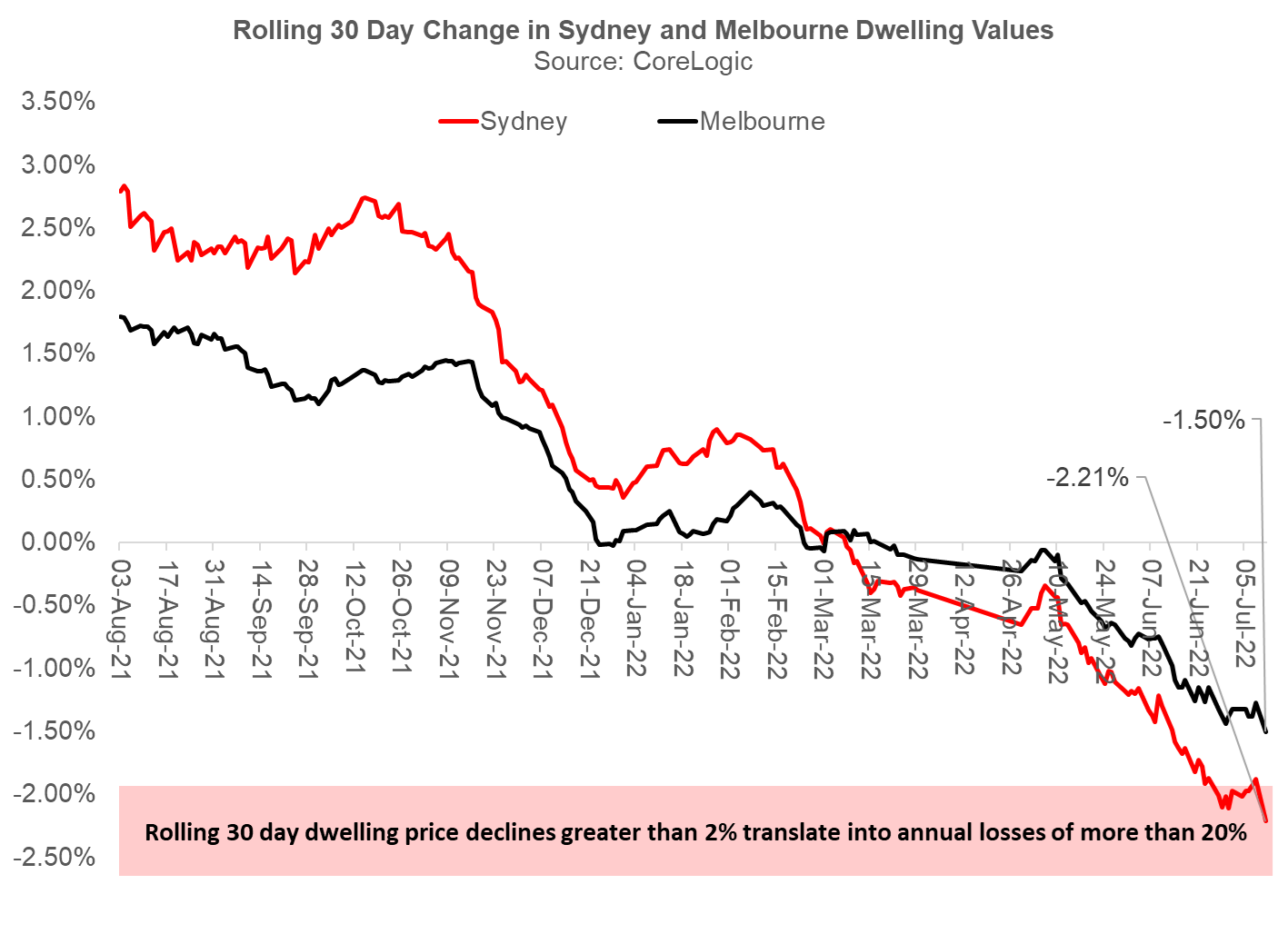

The Australian real estate market has been on a roller coaster ride in recent years, with a phase of prices soaring to record highs during Covid and then crashing ever since. The market is now facing a potential crash in 2022-2023, with experts predicting a significant drop in prices across the country. This could have a major impact on the economy, as the real estate sector is a major contributor to the nation’s GDP. In this article, we will look at the potential causes of the crash, the potential effects it could have on the economy, and what measures can be taken to mitigate the damage.

What Are the Predictions for the 2022-2023 Real Estate Market in Australia?

The future of the Australian real estate market is uncertain, but one thing is certain: the next two years will be a rollercoaster ride. The market is expected to experience a period of volatility, with prices fluctuating in response to a variety of factors.

The pandemic has had a significant impact on the real estate market, with prices dropping in some areas and rising in others. The economic recovery is expected to be slow and uneven, with some areas of the country experiencing a more rapid recovery than others. This could lead to further price fluctuations in the coming years.

The Australian government has implemented a number of measures to support the real estate market, including tax incentives and loan guarantees. These measures are expected to help stabilise the market and encourage buyers to enter the market.

The housing market is also expected to be affected by the increasing demand for rental properties. With more people unable to purchase a home, the demand for rental properties has increased and is expected to increase further. This could lead to an increase in rental prices in the long term, which could have a positive effect on the real estate market.

Overall, the real estate market in Australia is expected to remain volatile in the coming years. Prices are likely to fluctuate in response to a variety of factors, including the economic recovery, government measures, and the demand for rental properties. It is important to stay informed and be prepared for any changes that may occur.

What Are the Government Policies That Could Help Homeowners During the 2022-2023 Real Estate Market Crash in Australia?

As the Australian real estate market faces a potential crash in 2022-2023, the government must take decisive action to protect homeowners from financial ruin. To this end, the government should implement the following policies:

1. Increase the availability of low-interest loans for homeowners. This will help homeowners to refinance their mortgages and reduce their monthly payments.

2. Provide tax incentives for homeowners who choose to stay in their homes. This will encourage homeowners to remain in their homes, rather than selling them at a loss.

3. Establish a fund to help homeowners who are facing foreclosure. This fund could provide financial assistance to homeowners who are unable to make their mortgage payments.

4. Create a program to help homeowners who are underwater on their mortgages. This program could provide assistance to homeowners who owe more on their mortgages than their homes are worth.

5. Establish a rent-to-own program for homeowners who are unable to purchase a home. This program could provide an alternative to homeowners who are unable to purchase a home due to the market crash.

These policies will help to protect homeowners from financial ruin during the 2022-2023 real estate market crash in Australia. By taking decisive action, the government can ensure that homeowners are not left in a vulnerable position.

What Are the Risks of Investing in Real Estate During the 2022-2023 Real Estate Market Crash in Australia?

The looming real estate market crash in Australia during the 2022-2023 period is a cause for great concern. The risks of investing in real estate during this time are immense and should not be taken lightly.

Firstly, there is the risk of a significant decrease in property values. As the market crashes, property prices are likely to plummet, leaving investors with a significant loss on their investments. This could be devastating for those who have invested their life savings in real estate.

Secondly, there is the risk of a prolonged period of stagnation in the real estate market. As the market crashes, it is likely to take a long time for it to recover. This could mean that investors are stuck with their investments for a long period of time, unable to sell them or make any returns on their investments.

Thirdly, there is the risk of a lack of liquidity in the market. As the market crashes, it is likely that there will be fewer buyers and sellers in the market, making it difficult for investors to liquidate their investments. This could leave them stuck with their investments for a long period of time, unable to make any returns on them.

Finally, there is the risk of increased costs associated with investing in real estate. As the market crashes, it is likely that the costs associated with buying and selling property will increase, making it more expensive for investors to make any returns on their investments.

In conclusion, investing in real estate during the 2022-2023 real estate market crash in Australia is a risky proposition. Investors should be aware of the risks associated with such an investment and should proceed with caution.

What Are the Benefits of Investing in Real Estate During the 2022-2023 Real Estate Market Crash in Australia?

The 2022-2023 real estate market crash in Australia is a daunting prospect for many investors. However, those who are brave enough to take the plunge and invest in real estate during this time could reap significant rewards. Here are just a few of the benefits of investing in real estate during the 2022-2023 real estate market crash in Australia:

1. Lower Prices: The most obvious benefit of investing in real estate during a market crash is the lower prices. With prices dropping, investors can purchase properties at a fraction of their pre-crash value. This can be a great opportunity to purchase properties at a discount and then resell them for a profit when the market recovers.

2. Increased Rental Income: With prices dropping, rental rates tend to remain relatively stable. This means that investors can purchase properties at a lower price and then rent them out for a higher rate, resulting in increased rental income.

3. Tax Benefits: Investing in real estate during a market crash can also provide investors with tax benefits. For example, investors may be able to take advantage of depreciation deductions, which can help to reduce their taxable income.

4. Long-Term Investment: Investing in real estate during a market crash can also be a great long-term investment. As the market recovers, the value of the property is likely to increase, resulting in a higher return on investment.

By investing in real estate during the 2022-2023 real estate market crash in Australia, investors can take advantage of lower prices, increased rental income, tax benefits, and long-term investment opportunities. For those brave enough to take the plunge, the rewards could be significant.

How Can Homeowners Take Advantage of Low Prices During the 2022-2023 Real Estate Market Crash in Australia?

As the Australian real estate market continues to experience a crash in prices during the 2022-2023 period, homeowners have a unique opportunity to take advantage of the situation. With prices at an all-time low, now is the time to make a move and secure a property at a fraction of the cost.

For those looking to purchase a new home, this is the perfect time to do so. With prices at a historic low, buyers can find properties that are well below market value. This is an ideal opportunity to purchase a home that may have been out of reach before.

For those looking to sell their current home, this is also a great time to do so. With prices at a low, homeowners can expect to receive a higher return on their investment. This is a great way to make a profit and move on to a new property.

Finally, for those looking to refinance their current mortgage, this is the ideal time to do so. With interest rates at an all-time low, homeowners can save thousands of dollars in interest payments over the life of their loan.

The 2022-2023 real estate market crash in Australia is a unique opportunity for homeowners to take advantage of low prices. Whether you are looking to purchase a new home, sell your current home, or refinance your mortgage, now is the time to act. Don’t miss out on this once-in-a-lifetime opportunity!

What Opportunities Are Available for Investors During the 2022-2023 Real Estate Market Crash in Australia?

As the Australian real estate market braces for a crash in 2022-2023, investors have a unique opportunity to capitalize on the situation. With the market in a state of flux, investors can take advantage of the current uncertainty to purchase properties at discounted prices.

With hundreds of thousands properties that could come as distressed sale, the market crash presents a chance to purchase properties at heavily discounted price of their original value. Investors can purchase properties that have been foreclosed on or are in the process of being foreclosed on. This presents an opportunity to purchase properties at a fraction of their original value.

In addition, investors can take advantage of the current market conditions to purchase properties that are in need of renovation. These properties can be purchased at a discounted rate and then renovated to increase their value. This presents an opportunity to make a significant return on investment.

Finally, investors can take advantage of the current market conditions to purchase properties that are in high rental demand. These properties can be purchased at a discounted rate and then rented out for a profit. This presents an opportunity to generate a steady stream of income.

The 2022-2023 real estate market crash in Australia presents a unique opportunity for investors to capitalise on the current market conditions. By taking advantage of the current market conditions, investors can purchase properties at a discounted rate and then either renovate them or rent them out for a profit. This presents an opportunity to make a significant return on investment.

What Are the Long-Term Implications of the 2022-2023 Real Estate Market Crash in Australia?

The 2022-2023 real estate market crash in Australia will have far-reaching and long-lasting implications for the nation. The economic downturn will be felt by all Australians, from those who own property to those who are looking to purchase.

The most immediate impact of the crash will be a decrease in property values. Homeowners will see their investments depreciate, and potential buyers will find it more difficult to secure financing. This will lead to a decrease in the number of transactions, resulting in a decrease in revenue for real estate agents and other related businesses.

The decrease in property values will also have a ripple effect on the economy. With fewer transactions, there will be less money circulating in the economy, leading to a decrease in consumer spending. This will have a negative impact on businesses, leading to job losses and a decrease in economic growth.

The long-term implications of the crash will be even more severe. With fewer transactions, there will be less money available for investment in new projects. This will lead to a decrease in the construction of new homes, leading to a decrease in the housing supply. This will lead to an increase in housing prices, making it even more difficult for potential buyers to enter the market.

The crash will also have a negative impact on the government. With fewer transactions, there will be less money available for taxes, leading to a decrease in government revenue. This will lead to a decrease in public services and infrastructure, further impacting the economy.

The 2022-2023 real estate market crash in Australia will have far-reaching and long-lasting implications for the nation. The economic downturn will be felt by all Australians, from those who own property to those who are looking to purchase. The decrease in property values, the ripple effect on the economy, and the long-term implications of the crash will all have a negative impact on the nation.

What Strategies Can Homeowners Use to Protect Their Assets During the 2022-2023 Real Estate Market Crash?

As the 2022-2023 real estate market crash looms on the horizon, homeowners must take proactive steps to protect their assets. Here are some strategies to consider:

1. Invest in a diversified portfolio. By diversifying your investments, you can reduce the risk of losing money in a single market. Consider investing in stocks, bonds, mutual funds, and other assets.

2. Consider refinancing your mortgage. Refinancing your mortgage can help you lower your monthly payments and reduce your overall debt.

3. Consider renting out your property. If you own a rental property, consider renting it out to generate additional income. This can help you offset any losses you may incur during the market crash.

4. Consider selling your property. If you are unable to rent out your property, consider selling it. This can help you avoid any losses you may incur during the market crash.

5. Consider investing in alternative investments. Investing in alternative investments such as cryptocurrency, gold, and silver can help you protect your assets during a market crash.

By taking these proactive steps, homeowners can protect their assets during the 2022-2023 real estate market crash.

How Will the 2022-2023 Real Estate Market Crash Impact Homeowners in Australia?

The 2022-2023 real estate market crash will have a devastating impact on homeowners in Australia. As the market crashes, property values will plummet, leaving many homeowners with mortgages that are worth more than their homes. This will leave them in a precarious financial situation, unable to pay off their mortgages and unable to sell their homes.

The crash will also have a significant impact on the rental market. With fewer people able to afford to buy homes, the demand for rental properties will skyrocket. This will lead to an increase in rental prices, making it even more difficult for those who are already struggling to make ends meet.

The crash will also have a ripple effect on the economy as a whole. With fewer people able to buy homes, the construction industry will suffer, leading to job losses and a decrease in economic activity. This will have a negative impact on the entire country, as the economy will be unable to grow and recover from the crash.

The 2022-2023 real estate market crash will be a difficult time for homeowners in Australia. It is essential that the government takes steps to protect those affected by the crash and to ensure that the economy can recover quickly.

What Factors Contributed to the 2022-2023 Real Estate Market Crash in Australia?

The 2022-2023 real estate market crash in Australia was a devastating event that shook the nation to its core. It was a result of a perfect storm of factors that had been building up for years.

The first factor was the increasing cost of living in Australia. With wages stagnating and the cost of living rising, many Australians were unable to keep up with their mortgage payments. This led to a rise in foreclosures, which put downward pressure on the market.

The second factor RBA was trying to address the first factor: RBA increasing interest rates for 8 to 9 months to take it to the current 3.10% from 0.1%. is the most feared reality.

The third factor was the increasing number of foreign investors in the Australian real estate market. These investors drove up prices for many years, making it difficult for Australians to afford homes. This created an unsustainable bubble that eventually burst.

The fourth factor was the global economic downturn. The pandemic caused a sharp decline in the global economy, which had a ripple effect on the Australian real estate market. During this time with lowest interest rates Australians started to buy and sell properties driving the prices upto 30% in some areas

Finally, the fifth factor was the lack of government intervention. The government failed to take action to address the underlying issues that were causing the market to crash. This allowed the situation to spiral out of control, leading to the crash.

The 2022-2023 real estate market crash in Australia was a devastating event that had far-reaching consequences. It was the result of a perfect storm of factors that had been building up for years. It is a reminder of the importance of taking action to address underlying issues before they become too severe.

Conclusion

The 2022-2023 real estate market crash in Australia is likely to be a difficult time for many people. The combination of rising interest rates, rising unemployment, reduced consumer spending, and a decrease in foreign investment could lead to a significant decrease in property values. However, it is important to remember that this is a temporary situation and that the market will eventually recover, by the largest inflow of migrants initiative by Government. With the right strategies and investments, it is possible to weather the storm and come out on the other side in a better financial position.